How to Read a W-2 With Pictures

A Form West-2 is more than simply a piece of paper; it's 1 of the most important records yous need at tax time. Here's what a West-two is, how to empathize what'due south on it and how to go your W-ii.

What is a Form W-2?

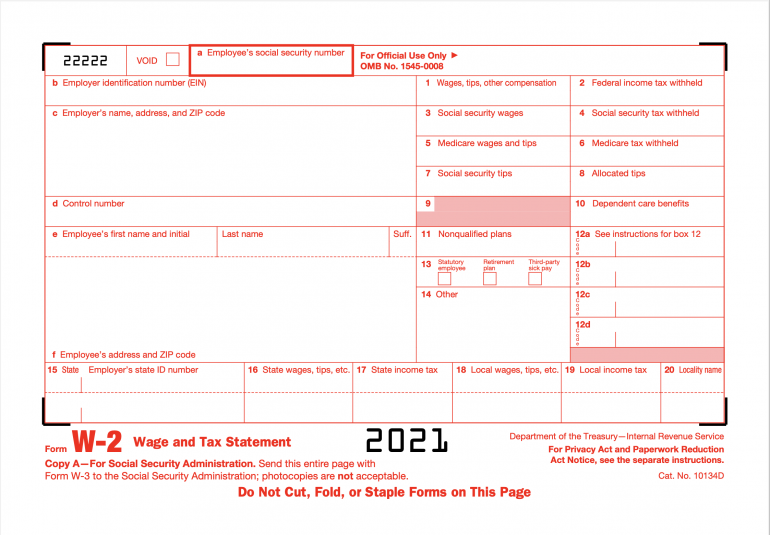

IRS Grade W-2, the "Wage and Tax Statement," reports an employee'due south income from the prior year, how much tax the employer withheld and other information. Employers send employees a Form W-2 in Jan (a re-create likewise goes to the IRS). Employees use Form Due west-two to prepare their revenue enhancement returns.

-

Your Course West-2 tells you lot how much y'all earned from your employer in the past year and how much withholding taxation y'all've already paid on those earnings. For many people, the information on the W-2 determines whether they're getting a refund or writing a check at tax time.

-

You should receive a W-2 from every employer that paid you lot at least $600 during the year. Tip income may be on your W-two. Freelancers or independent contract workers go 1099 s from their clients, not W-2s.

-

Don't confuse a W-two with a Westward-4 — that's the class y'all use to tell your employer how much taxation to withhold from your paycheck every pay period ( acquire how withholding taxes work ).

How do I become my Course W-2?

If your Due west-2 for the current year doesn't evidence up in the mail by Valentine's Day, first ask your employer for a copy and brand sure information technology'south got the right address. Your employer may also tell you how to get your Westward-2 online from the Hr department or payroll processor. If that doesn't ready things, call the IRS ( hither's a list of useful IRS phone numbers ). You'll need to provide information well-nigh when you worked and an estimate of what yous were paid.

-

Remember that your tax return is still due by the tax-filing deadline , so if yous don't have your Westward-2, you might need to estimate your earnings and withholdings to get it done on time. ( Get here to acquire more about getting an extension .) The IRS might delay processing your return — read: refund — while it tries to verify your information.

-

If your W-2 finally shows up after you already filed your tax return, you might need to go dorsum and amend your tax return .

Nerdy tip: If you're looking for a copy of an quondam W-2 that you lot attached to a prior revenue enhancement return and you can't get a re-create from the employer that originally issued information technology, you lot can asking an IRS tax transcript online or use IRS Form 4506 to request a copy of your tax return.

When should I receive my Form W-2?

The IRS requires employers to furnish W-2s to the government and employees past Jan. 31 or face penalties. The IRS generally defines furnish as "get information technology in the postal service," which means you lot should have yours in hand past the first week of February. Employers can likewise send employees their Due west-2s electronically, but it's non required. That means yous may be able to get yours online.

Even if you lot quit your chore months agone, your ex-employer can notwithstanding wait until Jan. 31 to send yous a W-2 — unless you inquire for it before, in which example the employer has xxx days to provide it.

| |

Promotion: NerdWallet users get 25% off federal and state filing costs. |

| |

Promotion: NerdWallet users tin can save up to $15 on TurboTax. |

| |

|

How a Form W-2 works

You utilise the Westward-2 to file your tax return. Course W-2 shows more than but what y'all were paid. It also details how much you contributed to your retirement programme during the twelvemonth, how much your employer paid for your health insurance, or fifty-fifty what you lot received in dependent intendance benefits. All of that information affects your tax picture — your retirement contributions might not be taxable , for example.

Box 1: Details how much you were paid in wages, tips and other compensation.

Box two: Shows how much federal income tax was withheld from your pay.

Box 3: Shows much of your pay in Box one was subject to Social Security tax.

Box four: Shows how much Social Security tax was withheld from your pay.

Box 5: Shows much of your pay in Box 1 was field of study to Medicare revenue enhancement.

Box six: Shows how much Medicare taxation was withheld from your pay.

Box vii: Shows how much of the tip income you reported to your employer (those tips are included in Box 1 ) was bailiwick to Social Security tax.

Box 10: Shows the amount of dependent care benefits your employer paid to you or incurred on your behalf. Note: Mostly, annihilation over $v,000 ($2,500 if you're married by filing separately) is detailed in B ox one too. For the 2021 tax year (taxes due in April 2022), the American Rescue Plan Act permits employers to increase this amount to $10,500 ($5,200 for married filing separately).

Box 11: Generally, this box shows how much money was distributed to yous during the year from your employer's deferred compensation plan.

Box 12: Here, there are four areas in which the employer tin provide more item well-nigh some or all of the pay reported in Box one. For instance, if you've contributed to your company's 401(k) plan, the amount of your contributions might show up in Box 12 with the code letter of the alphabet "D." There are many codes, which you tin see in the IRS'due south Due west-2 instructions .

Box xiii: This box indicates whether your earnings are subject field to Social Security and Medicare taxes but aren't subject to federal income tax withholding, whether you participated in certain types of retirement plans, or whether you got certain kinds of sick pay.

Boxes sixteen-19: Show how much of your pay is subject to state income tax, how much state income tax was withheld from your pay, how much income was subject to local taxes, and how much local taxation was withheld from your pay.

What to do if your W-2 is incorrect

If your employer leaves out a decimal point, gets your name or a dollar amount wrong, or checks the wrong box — it happens — betoken out the fault and ask for a corrected W-two. Pointing out the fault and waiting for a new W-2 volition cost yous time, but hither'southward something that could make you feel better: The IRS might fine your employer if the mistake involves a dollar corporeality or "a significant item" in your address.

Your Due west-2 information is non a secret

You won't get away with anything if you merely shove your W-ii in a drawer and decide not to put the data on your tax return. Employers are legally required to send copies of your W-2 to the Social Security Administration and IRS ("Re-create A") and your state and local tax authorities ("Copy 1"). You'll probably go a terse letter and a few months' worth of headaches from the IRS — and the state, if your state has income taxes — afterward they compare the income you reported on your tax return to the information your employer sent to the government.

Source: https://www.nerdwallet.com/article/taxes/what-is-w-2-form

Post a Comment for "How to Read a W-2 With Pictures"